Utility-Scale Solar Development in California

In 2002, the State of California recognized the economic, social and environmental benefits of renewable energy and adopted one of the country’s first RPS. The RPS required Investor Owned Utilities (IOU) to increase sales of energy generated from renewable resources by at least 1 percent each year to reach a total of at least 20 percent by 2017. The RPS legislation modified the pricing policies for renewable energy by directing the CPUC to establish market price referent (MPR) to represent the avoided costs of non-renewable power purchases. The MPR is used to calculate the net present value of the levelized cost of energy (LCOE) for a long term contract. Unlike previous pricing policies, the MPR is calculated based on installed capital costs, fixed and variable operations and maintenance costs, natural gas fuel costs, cost of capital, and environmental permitting and compliance costs. If an IOU enters a contract with pricing below the MPR, the cost can be recovered in retail sales. Contracts for long term purchases above the MPR may qualify for above-MPR funds from the state’s RPS program.1 However, these funds are limited. The modified pricing policies help utilities control the costs of meeting RPS goals and the contracts help to make utility-scale projects feasible once again from a developer’s perspective.

The recent rise in the number of utility-scale projects in development is attributable to two key factors: the longer-term extension of production and investment tax credits to match the development timeline, which can take several years, and the implementation of aggressive RPS goals in California. Longer- term tax credits provide some certainty for investors and RPS goals create market demand among utilities seeking renewable energy power purchase agreements.

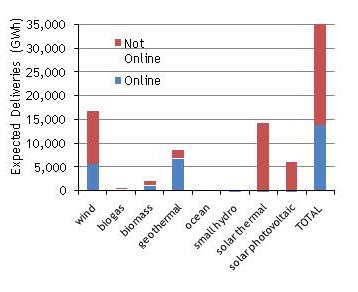

By the end of 2009, utility-scale development was expected to grow significantly2 and the state of California once again amended the RPS by adding a secondary target of 33 percent by 2030. This new target covers IOUs as well as publicly owned utilities and is truly a statewide goal, leaving many utilities wondering how much utility-scale generation would be needed to meet the targets (Figure 1). Once again, pricing may be an issue as “nearly half of the projects submitted for CPUC approval have been above the MPR” since 2007.3 This is an indication that the cost of producing electricity from solar energy is still more expensive than other resources but the number of renewable energy contracts available to utilities is limited. Transmission issues will also have an impact on utility-scale development because new or upgraded transmission infrastructure will be required in order to bring a large number of projects online.

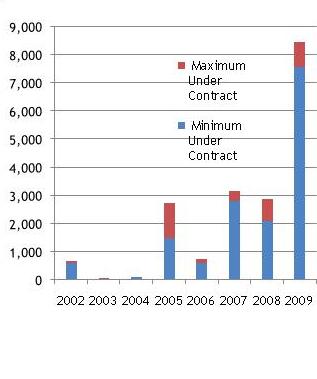

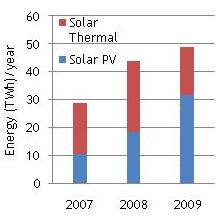

The potential for utility-scale solar energy development in the California desert is clear in terms of the available solar resource and improved financial incentives. However, utility-scale developers also desire an expedited process for accessing large tracts of public land as they moved forward with siting decisions development plans. In 2008, the BLM announced it would soon revise land use plans to incorporate renewable energy development. The market incentives combined with a potentially easier permitting process catalyzed a public land grab among developers eager to secure inexpensive land, attract recovering investors, and build the expansive facilities that could meet the IOU’s pressing need for renewable energy created by the more aggressive RPS targets. In order to meet the California RPS goal of 33 percent renewable energy by 2020, 48 terawatt hours of new renewable energy need to be brought online.4 In response to utilities’ requests for proposals for renewable energy generation capacity needed to meet RPS goals, solar developers began to submit their bids and in 2007 four contracts for utility-scale PV installations were filed with the CPUC (Figures 25 and 36). The CPUC predicted increases in development activity in its 2008 first-quarter RPS procurement status report:

“Solar energy has historically been a high-cost resource due to supply chain production constraints and other factors. However, its on-peak energy production and relatively consistent capacity are valuable, and increased developer activity is expected to drive prices downward. As prime wind resources are developed, leaving resources with lower capacity factors and higher prices, the price gap between wind and solar energy may narrow, making solar facilities more attractive and further boosting solar development.”7

1 California Public Utilities Commission, Renewable Portfolio Standards Quarterly Report, January, 2008, http://www.cpuc.ca.gov/PUC/energy/Renewables/documents, 9.

2 State of California Public Utilities Commission, 33% Renewables Portfolio Standard Implementation Analysis Preliminary Results, 2009, http://www.cpuc.ca.gov/NR/rdonlyres/1865C207-FEB5-43CF-99EB- A212B78467F6/0/33PercentRPSImplementationAnalysisInterimReport.pdf, 1.

3 California Public Utilities Commission, Renewable Portfolio Standards Quarterly Report, July, 2009, http://www.cpuc.ca.gov/NR/rdonlyres/EBEEB616-817C-4FF6-8C07- 2604CF7DDC43/0/Third_Quarter_2009_RPS_Legislative_Report_2.pdf, 12.

4 California Public Utilities Commission, 33% Renewables Portfolio Standard Implementation Analysis Preliminary Results, 2009, http://www.cpuc.ca.gov/NR/rdonlyres/B123F7A9-17BD-461E-AC34- 973B906CAE8E/0/ExecutiveSummary33percentRPSImplementationAnalysis.pdf

5 California Public Utilities Commission, Renewable Portfolio Standards Quarterly Report, Q1, 2010, http://www.cpuc.ca.gov/NR/rdonlyres/7DA38E61-9DB9-4B4E-A59C-D0776AF3B0BB..., 5.

6 California Energy Commission, Database of Investor-Owned Utilities' Contracts for Renewable Generation, “Contracts Signed Towards Meeting the California RPS Targets, Updated December 15, 2009,” http://www.energy.ca.gov/portfolio/contracts_database.html (accessed 5 February, 2010).

7 California Public Utilities Commission, Renewable Portfolio Standards Quarterly Report, January, 2008, http://www.cpuc.ca.gov/PUC/energy/Renewables/documents, 23.