Mobile Marketing Overview

From The Yaffe Center

m (→Definition) |

m |

||

| Line 36: | Line 36: | ||

[[Image:ycmm_MobileMarketingHandbook.png|300px|thumb|left|The Mobile Marketing Handbook]] | [[Image:ycmm_MobileMarketingHandbook.png|300px|thumb|left|The Mobile Marketing Handbook]] | ||

| + | |||

== Customers == | == Customers == | ||

Revision as of 16:36, 14 November 2010

NOTE: This page is work in progress. Check back later for more updates--Nkr 14:54, 7 November 2010 (EST)

Contents |

Acknowledgements

A large portion of this Wiki was taken from the research paper “Get Connected: Developing Successful Mobile Marketing Strategies” by Robyn Bald, student at the Ross School of Business, written in April 2010.

Introduction

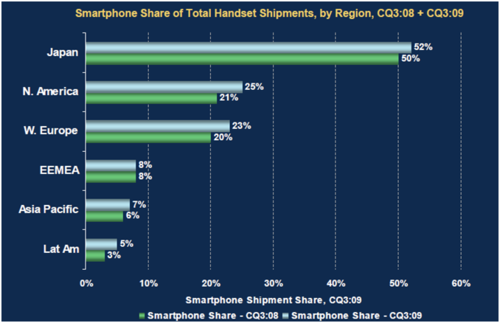

The Mobile Marketing Association reports that there are over 3.3 billion handsets worldwide, more than 3 times the number of personal computers globally. According to Nielsen, in November 2009, 61.5 million Americans accessed the Internet via mobile devices, up 32% from a year earlier. Morgan Stanley’s 2009 Mobile Internet Report claims that within 5 years, more users will connect to the Internet via their mobile devices versus with desktop personal computers. The third screen device is now omnipresent; mobile is the perfect platform, on which to connect one-on-one with consumers. Mobile is more than its own unique marketing channel; it is a unique mass media. Mobile is here to stay, and it is positioned to be the next major distribution platform.

“The virtual Velcro that attaches these devices to their owners, combined with the coming explosion in mainstream consumers accessing data services on their phone, is reason alone to break ground on a mobile strategy.” -Julie A. Ask and Charles S. Golvin, Forrester Research, April 2009

Dushinski outlines four reasons for companies to embark on mobile initiatives:

- Acquisition of new customers.

- Increased sales to current customers.

- Retention of current customers.

- Brand awareness.

At the core, these objectives encompass why a company should go mobile. However, in this environment, these goals are not mutually exclusive, e.g., brand awareness can be achieved while also increasing retention. Further, one can develop a taxonomy of mobile marketing programs by subdividing the aforementioned overarching objectives.

According to eMarketer, in 2009, $416M was spent on mobile advertising versus $24B spent overall in online advertising. Therefore, total mobile spending is just 1.7% of all online, yet projected growth is high, averaging 36.5% in 2010. Companies must anticipate this growth and leverage the channel to their advantage. There are numerous ways to market to customers through their devices: voice, applications, messaging, the mobile web, mobile advertising. In order to develop an appropriate mobile strategy, marketers must first determine their target audience, establish clear brand or product objectives, and understand how specific mobile tactics will assist in accomplishing these goals. Based on both primary and secondary research, this page defines the mobile landscape and presents tactics and strategies for developing a company’s mobile marketing footprint.

Definition

“Mobile Marketing is a set of practices that enables organizations to communicate and engage with their audience in an interactive and relevant manner through any mobile device or network.” -Mobile Marketing Association, November 2009

The Mobile Marketing Handbook defines mobile marketing as “[connecting] businesses and each of their customers (through mobile devices) at the right time and at the right place with the right message and [requiring] the customer’s explicit permission and/or active interaction.

Mobile marketing spans a variety of activities and tactics, most notably phone applications, SMS and MMS messaging, display advertising and mobile-optimized websites.

Customers

Teenagers are the heaviest users of mobile data, but while the absolute percentages are not as impressive for adults, they represent a substantial segment of the population. The 35% of Boomers, those aged between 43 to 63, who use text messaging does not sound nearly as noteworthy as the 65% of Gen Yers who text, but it does represent more than 21 million adults. Although activity and engagement levels vary, mobile marketing opportunities exist across all age groups. Forrester Research has segmented adults into six groups to formulate the company’s Mobile Technographics characterization; the groups are defined by the extent to which a user has adopted mobile data services, frequency of use of these services, and the level of sophistication in the mobile applications used.

1. Inactives

Inactives do not own mobile phones and represent 19% of the United States’ adult population. This segment tends to be older adults or senior citizens who have resisted mobile technology due to a lack of perceived utility.

2. Talkers

Talkers represent 35% of adults and use their mobile devices strictly for voice. They are the least sophisticated of all mobile users, and this lack of sophistication is also apparent at home, where they passively consume content.

3. Communicators

With an average age of 39, Communicators are much younger than the previous two segments. In addition to voice, Communicators use messaging services such as SMS or MMS but no other data services. They represent 13% of adults.

4. Connectors

Connectors represent 19% of adults, and about one-third of them own a smartphone. They are defined by efficiency; Connectors use applications to improve productivity, such as email and navigation tools, albeit without a great level of frequency.

5. Entertainers

Entertainers are the youngest segment, with an average age of 35, and they skew more female than male. This group represents 20% of adults and is defined by their desire to seek out and purchase entertainment content and applications for their mobile devices. However, this group also consumes a lot of entertainment beyond mobile.

6. SuperConnecteds

As triggered by the segment’s name, SuperConnecteds are the most active mobile users, taking advantage of their device for numerous activities, such as shopping, checking stock quotes, social networking, and research. Forty percent of SuperConnecteds own a smartphone, and they are more likely to be male than female.

Understanding each of these groups as well as their similarities and differences is critical for marketers to properly craft their campaigns and target the appropriate segment(s) based on company objectives. It is also important to monitor how these groups evolve and how behaviors change, potentially creating an entirely new segment or merging existing ones. Leveraging this knowledge will allow marketers to more easily identify their target audience and the mobile tactic to best reach them.

Tactics

Voice

Voice is where it all began, from which a mobile phone was born. Every mobile user has access and can interact with a brand or company via voice: person-to-person, person-to-computer or person-to-recording. While other mobile tactics have generated significantly more buzz, voice should not be ruled out as a marketing tool. Marketers can encourage voice interaction by giving consumers a reason to call or listen, specifically on their mobile phones. Voice is still a powerful tool; it is accessible by the masses, requires no learning curve, and can actually serve as a unique tactic. Given the rush to embark on new technologies and trends, using voice may be a refreshing visit to the past and positively reflect on a brand or company.

SMS/MMS Messaging

Like voice, text messaging is a universal application. Even the most basic cell phone can send or receive a message, and the technology is the same across devices and carriers. There are two steps to embarking on a mobile messaging campaign: gaining permission and determining both a short code and keyword. In order to avoid spamming and complaints, marketers must offer a compelling value proposition to the consumer so that she will opt-in to receive mobile communication. Secondly, to activate the campaign, one must promote a short code and keyword, similar to how American Idol fans can text the keyword “VOTE” to the 4 digit short code designated for each contestant. There are numerous types of text messaging campaigns, and companies are becoming more creative with the 160-character maximum everyday. Some options for campaigns are subscription, couponing, alerts, voting and contests.

Mobile Search

No matter the simplicity of a company or brand’s URL, consumers will first turn to search to link to the site. Therefore, it is imperative that a company’s website surfaces during search. Marketers must employ search engine optimization (SEO) to ensure that search engines know of the website’s existence and what search terms are relevant for site placement. However, the tactics that work on the Internet do not necessarily work for mobile search, particularly because fewer results can be shown on a page and because carriers default to certain search engines, which may influence results.

Mobile Website

The Mobile Marketing Handbook defines the mobile web as the Internet accessed via a mobile device; however, this is deceiving because mobile devices do not provide the same Internet experience as personal computers or other Internet-enabled devices. Therefore, there are multiple approaches to building a mobile-optimized website, four of which are outlined below:

One Web

One school of thought is the idea that one web exists and that people want the exact same experience on their mobile devices as they want on their computers. Apple is a proponent of this strategy, as evidenced by their first iPhone commercials, which emphasized surfing the true Internet, not a watered down version. More specifically, the June 2007 commercial touts that the iPhone delivers “not a watered down version of the Internet, or the mobile version of the Internet or the ‘kinda/sorta looks like the Internet’ Internet. It’s just the Internet on your phone.”

Miniaturization

Another option is to create a single website, with one URL that subsequently uses technology to determine how users will view it, e.g., if they are on a mobile device, the site will display in the appropriate size. However, this strategy is foolish because users do not navigate the mobile web in the same way that they navigate the Internet on a computer. Mobile users need snapshots of information, such as a store locator, product availability or restaurant menu, which they are able to find quickly. Therefore, while miniaturization may deliver a consistent experience to consumers, it does not segment based on need-states.

Mobilization

A third option is to build two separate websites, one optimized for computers and one for mobile devices. These sites would have two URLs, and users would decide which site was appropriate based on their usage occasion. This strategy is difficult because it requires the company to educate consumers and also trusts that consumers will remember to distinguish between sites.

Personalization

This solution provides the user with one website URL, but it is different than the “one web” strategy because two different sets of content are presented to the consumer, based on the type of device. While technically more complex, this solution is ideal because the user experience is customized based on the device, delivering the most relevant information to the user with each interaction.

Applications

Applications are a great marketing tool, if you can specifically direct consumers to finding your brand’s app and if that app provides significant value. “Apps have a huge advantage,” said Carl Howe, a mobile market analyst for the Yankee Group. “You had to take a step to get it; you are already half sold.” Therefore, marketers can expect higher engagement and hence higher brand recognition and awareness. With an application, marketers can appeal to brand loyalists or new customers; multiple applications can be developed for different segments. Applications are an exciting and new way to reach consumers, but marketers must not focus solely on this mobile outlet because other mobile tactics may be more appropriate for reaching a brand’s target consumer.

Apple's App Store is a great example of a successful Applications strategy. Apple’s App Store alone separates its applications into 20 different categories, ranging from books to social networking to weather. With more than 185,000 applications, Apple recently said that consumers had downloaded more than four billion applications. And with the emergence of other application stores, more value will be created and accessible beyond the iPhone. Although application marketing receives a lot of attention and is on trend, companies must understand that while applications may help to drive buzz and attract loyal consumers, revenue opportunities are small and will continue to be minimal. For instance, in 2009, applications generated $1.68 per download, with average revenue predicted to decline to $1.50 in 2010 and $1.36 in 2013. Free can be valuable particularly if one is attempting to encourage trial or if the application solicits more transactions (e.g., m-commerce or store locators). However, given the variety of devices and increasing number of application stores, marketers must consider the development costs as well as the value of offering an application versus an alternate mobile strategy.

Video

Marketers can approach mobile video similar to how they approach text messaging. They can create video content to share directly with mobile users or influence user-generated content, which will spread more organically. For example, having partnered with Mogreet Inc., American Greetings now offers a service that transmits a video card chosen from its web site directly to handsets of nearly all major mobile carriers. The National Football League is also exploring video. It started a campaign to show fans a glimpse of players off the field and prompted them to text a keyword to receive a video featuring players from The New York Jets and other teams; by doing so, fans were automatically entered into a sweepstakes for a trip to the 2010 Players Rookie Premiere. Video is an evolving tactic, requiring more effort on both the parts of marketers and consumers. However, if brand appropriate, video can be extremely compelling and engaging.

Twitter is a force to be reckoned with and also to be understood. The number of active Twitter users exceeds 20 million, a number that is predicted to grow substantially. According to a study conducted by Weber Shandwick, 73 of the Fortune 100 have registered a total of 540 accounts; out of this total, 50 percent of the accounts had fewer than 500 followers and another 15 percent were inactive; of these inactive accounts, 11 percent were placeholder accounts, used to protect the corporation’s name and 4 percent had been abandoned after being used for a specific event. Also and more importantly, 53 percent “did not display personality, tone or voice on their account pages,” according to the report, which judged personality based on whether an account was identified with a personality who posted on behalf of the company or if it was a “faceless” brand account. Twitter recently revealed an advertising model, describing its Promoted Tweet platform as “ordinary Tweets that businesses and organizations want to highlight to a wider group of users.” Best Buy, Bravo, Red Bull, Starbucks and Virgin America are among the brands first testing the promotional service.

Mobile Advertising

In addition to having a dedicated website for a brand, companies can advertise on the mobile web, similar to traditional online advertising. There are numerous way to advertise via the mobile web: banner advertising, in-app advertising through product placement or direct advertisement, video, or even twitter sponsored results. Companies can leverage their knowledge of online advertising and translate it to the mobile web. However, they must consider how consumers navigate the web via mobile versus on laptops or desktops to develop advertising creative that is suitable and effective on a mobile device.

Practical Checklist

Forrester proposes the POST approach as a methodology for developing a mobile strategy: People, Objectives, Strategy, and Technology. The following section details this methodology while also offering other elements of critical consideration.

Know Your Target; Don’t Just Check the Box! (Forrester’s P: People)

Start with consumers of your brand. Are all users of your brand alike? Do your most loyal and dedicated followers require special attention and a unique strategy? As a manager, it is easy to peruse your marketing mix toolbox and simply check each tactic’s box without assessing its strategy and relevancy. First, marketers must understand how their target consumers are using mobile and not rely on the trends of early adopters or on the average mobile user’s profile. An initial approach would be to consult the six mobile profiles discussed earlier and determine which segments are most appropriate or attractive for an offering. Is mobile even the right tactic or are you just employing a “me too” approach and jumping on the “new” bandwagon? For example, in the aforementioned Hearos discussion, the company jumped on the mobile application bandwagon without considering the behaviors of its target consumers or the utility they would require from a mobile offering.

Set Your Objectives; Then Assess Technology (Forrester’s O: Objectives)

“The goal is to understand the tactical opportunities and create a mobile campaign strategy based on marketing objectives and the target audience – not based on the technologies alone.”—Bryce Marshall, Director of Strategic Services at Knotice.

It is important to determine the company’s overall strategy and objectives and then assess why mobile marketing would be applicable for achieving these. As noted, there are four general objectives for engaging in mobile initiatives: acquisition of new customers, increased sales to current customers, retention of current customers, and brand awareness. Marketers must decide what they are seeking to accomplish and then justify meeting these objectives via mobile versus through another marketing channel.

You Have the What; Now Where’s the How? (Forrester’s S: Strategy)

Having established specific objectives, it is now time to develop a plan of action. What will the mobile offering actually be, and is it a one-time promotion or long-term commitment to the channel? How will you integrate your mobile initiative into the overall marketing mix?

The Implementation: To Text or Not To Text? (Forrester’s T: Technology)

Finally, it is time to decide which mobile marketing tactic will be most effective. This is highly dependent on the mobile sophistication of the target audience and on the utility of the campaign. Additionally, it is dependent on the resources available for the initiative, as they must mirror the development requirements. Does your offering need to be available on all types of devices and accessible to the masses? Or are you crafting a specific benefit to only be redeemed by a particularly type of mobile user? Also, are you expecting to leverage this platform for other brand initiatives or will this be a one-time development cost and engagement?

Go Local if it Delivers Value

Location-based initiatives can increase relevancy for both consumers and marketers. However, these offerings must be appropriate and not invade privacy by capturing or revealing too much information about the user. Bank of America’s ATM locator delivers local value yet The North Face’s location-based promotional messages may tread the line. Bank of America employs a “pull” strategy by allowing consumers to seek out the required information whereas The North Face “pushes” offers at its customers based on their proximity to a retail outlet. Consumers do opt-in to receive the retailer’s messages, but the company risks them opting-out of the service, should messages become too frequent, irrelevant or even hyper-relevant. For example, if The North Face partners with Expedia to find out that a customer is are soon traveling to the Alps and then recommends the purchase of hiking poles, this could worry consumers and alienate them from the brand. Local has tremendous potential in mobile marketing, but it must not be exploited. Delivering coupons at the point of sale or to drive consumers in-store can mutually benefit consumers and marketers, but relevancy, not volume, is crucial.

Reinvent, Retrigger and Stay Relevant

Mobile technology is evolving and so should your mobile strategies. It is imperative that a brand’s mobile presence is relevant and updated according to changing consumer preferences and behaviors. For example, Zippo first developed its free Virtual Lighter application to drive awareness and build brand affinity. Now, having succeeded with this strategy to generate a solid user base of brand advocates, the company intends to upgrade its customers by offering additional premium features to design even more customized, unique lighters. Additionally, understanding that not all consumers need the extensive features of the iFood Assistant, Kraft subsequently created a free version of the application to broaden its user base and appeal. Marketers must tweak their strategies based on past initiatives and feedback. They must be ready to reassess and reinvent.

Measure Effectiveness and Develop a Success Profile

It is important to track mobile successes and failures and to understand what contributed to each. Measurement is key, and it must be specifically defined. Was the company goal to attract a certain number of new customers or to convince more existing customers to upgrade their service? Was the goal to achieve a target number of downloads or to gain placement on the App Store homepage for a consecutive number of weeks? There are endless ways to measure mobile effectiveness yet there is no industry standard, as measurement tools and capabilities are constantly evolving. Pepsi’s Chris Epple, Director of Media Strategy, notes that impressions are vastly different from engagement. Engagement actually delivers value—creating something sticky that you want and need. Therefore, goals can vary depending on company objectives. However, marketers can set company-specific goals and revisit them based on technological developments or competitive reactions. What is most important is that some element of measurement is predetermined. Marketers can then use these goals to record and analyze mobile campaigns to develop best practices and innovate based on past learnings.

Effectiveness Measures

There is no straightforward definition for mobile success as no clear translations exist between certain mobile efforts and effects on the marketed brand or product. For example, how does Charmin measure the success of its Sit or Squat initiative? Sure, the offering increases brand awareness for those that are using the restroom-locating tool, but were these Charmin loyalists to begin with? Measurement is a challenge, and assessing effectiveness will vary based on each tactic.

Companies must attempt to quantify the potential benefits of a mobile offering. For example, per the graph below, if a company is choosing to target consumers via mobile messaging, it should quantify the current and predicted availability of a technology. Secondly, the company should understand that just because the technology is available does not mean that it will be adopted by all mobile users with access to said technology. Lastly, one must assume that only a subset of those who have adopted the technology will actually be exposed to and use your brand’s offering. This funneling exercise establishes potential total adoption of a marketing tactic. Determining this baseline allows for an easier assessment of effectiveness and reach.

Certain mobile tactics are easier to measure than others. For example, when delivering a mobile coupon, the company will know both how many were sent and how many were redeemed, similar to the assessment of physical coupons. Similarly, mobile web page views and purchase conversions can be counted. However, the real challenge is first establishing a goal for these conversions.

What defines success is different for each company and product, and baselines should vary accordingly. For example, Amazon certainly has different expectations for mobile purchases of e-books versus e-readers. Companies must set specific goals, based on prior mobile knowledge or related initiatives involving other elements of the marketing mix.

Applications are the latest mobile craze and therefore lack sophisticated measurement, both due to lack of transparency from carriers and device manufacturers and to lack of defined and prioritized data points. Most brands have relied on the number of application downloads to benchmark success, and these limited metrics are somewhat related to the lack of information provided by Apple. The company simply reports number of downloads, without specifying the allocation between iPhones and iPod Touches. As noted in Forrester Research’s Mobile Strategy Report, companies must better track their applications to assess the demographics of their users and frequency of access and usage. Just tallying the number of downloads and noting the related application ranking will not suffice. Companies must capture more detailed information about application users and continue to target these consumers by iterating on existing tools or delivering additional value through different tactics.

Examples

Charmin

Procter and Gamble’s Charmin has engaged in nontraditional branding efforts for a long time, beginning in 2000 with its “Charminizing” program to clean state fair restrooms. Given this past experimentation with marketing techniques, it is no surprise to see the brand’s foray into mobile. Charmin’s Sit or Squat application, available on both iPhones and Blackberries, launched in December 2009. The application as well as website, sitorsquat.com, helps consumers locate public restrooms and provides ratings based on their cleanliness and other amenities. The Sit or Squat effort is successful beyond its more than half a million unique visitors and 1,600 downloads because it truly provides a utility to its users. Charmin’s branding is subtle, as shown in the screenshot below, and this effort employs a pull strategy. Consumers must seek out the tool, but they have a reason to do so. Most people know what it is like to anxiously be searching for a public restroom; this is mobile functionality at its finest. While it may not translate into increased sales, Charmin’s mobile strategy is consistent with its overall brand positioning—fun, family-friendly and safe.

Wendy's

Wendy’s promoted the franchise’s Applewood Smoked Bacon burger with a campaign centered on a Twitter contest. The "Bacon Hunt" contest, launched in November 2009, gave points to Twitter users following @UrBaconMeCrazy for performing different tasks, like updating about bacon or knowing how many bacon slices were on the new burger. The "Bacon Hunt" contest ran for just under two weeks -- "12 days of bacon" -- and awarded one bacon lover with $2,000 upon its conclusion. Additionally, during the contest, Wendy's gave away a $200 gift card every day. As of March 31, 2010, well beyond the contest’s end date, @UrBaconMeCrazy boasts 2,113 followers and 671 total tweets. It is difficult to assess whether or not this number of followers and level of interaction can be deemed a success. However, this initiative promoted the new offering to the bacon-obsessed, a key target for the product. This group consists of Wendy loyalists and prospects so it is important that Wendy’s continues to be involved in the Twitter bacon conversation by promoting new products, suggesting ways to enhance Wendy’s offerings with more bacon, or even proposing uses for bacon outside of the fast-food channel.

CNN

Louis Gump, CNN’s Vice President of Mobile views mobile as a core part of the company’s future and believes that at some point in time more people will get news from mobile than online. The company’s mobile website attracts an estimated 11.5 million unique users per month, and, since its launch in September 2009, the CNN iPhone application has continued to be one of the top news applications in the store. News is sometimes considered a commodity product so it is important that CNN differentiates itself in the marketplace. With its $1.99 price point, CNN has signaled its value and maintained its strong brand equity among consumers.

Bank of America

Adoption of mobile banking lags far behind customer awareness. Eighty-five percent of online US bankers are aware of mobile banking options, but only 10% have adopted them. Despite this, Bank of America has seen steady growth since the launch of its mobile banking initiatives in May 2007. By June 2008, it reported one million active mobile customers; by May 2009, it had 2.4 million users logging on an average of 10 times per month. Bank of America focused on the user experience, providing service and convenience to strengthen customer relationships and ultimately increase revenues. Three percent of Bank of America's customers have transferred funds from one account to the other in the past year via their mobile phone, and 3% have also used mobile banking to pay their bills. These mobile banking transactions account for more than $7 billion annually in transfers. To encourage the widest adoption of its mobile banking services, Bank of America has developed applications for most platforms—Android, Blackberry, iPhone, and Windows Mobile—and all are available for free. Customers can also access Bank of America's mobile banking services through a website optimized for the mobile Internet, although it lacks some of the application services, such as the ATM and banking center location finder. In summary, Bank of America's offerings allow for many of the same services that are available through online banking but with the addition of location-based services.

Zippo

Zippo identified an opportunity as mobile device screens became larger. It is common knowledge that lighters are frequently used at concerts or other live events to jam along and show support for the artist. Therefore, to revitalize its image and generate increased awareness in a stale category, in 2008, Zippo created the Virtual Zippo Lighter application for the iPhone and iPod Touch. The application features a selection of designs to customize the look of the lighter, allows users to engrave their lighter and displays an animated flame that reacts to the phone’s movements. The application has been a success due to its utility, simplicity and creativity. It currently ranks in the top 20 iPhone apps of all time, according to comScore Inc. It has reinvigorated the Zippo brand due to its novelty and because it has extended its reach to consumers who do not need real lighters but want to engage with them from a social standpoint at a live event. The company has acknowledged that the application primarily serves as a branding too, with its free offering. However, it intends to monetize the application moving forward by allowing customers to customize their lighters by purchasing logos, colors, textures, etc.

The North Face

In November 2009, The North Face partnered with location-based mobile advertiser, Placecast, to roll out a mobile marketing campaign in New York, Boston, San Francisco, and Chicago. These markets were chosen based on their high density of North Face retail stores and on their ever-changing, unpredictable climates, which allows the retailer to promote specific weather-appropriate apparel. The goal of the initiative is to drive consumers in-store by offering relevant promotions and discounts based on their proximity to a retail outlet. The campaign’s goal is clear, and rolling out the initiative in targeted cities makes perfect sense. However, consumers must opt-in to receive these text message offers, and it unclear how The North Face is marketing the service through other channels. How is the company generating awareness for the opt-in? Additionally, how customized are these messages, meaning if it is raining in San Francisco, will customers near the retail stores be sent promotions for rain jackets and waterproof pants? Or is the service mass customized with consumers receiving the same offers, regardless of specific city conditions? By introducing this tactic, The North Face will gain valuable consumer information and preferences. It will be able to tweak offerings and determine which promotions are most likely to drive consumers in-store.

American Airlines

American Airlines, as well as other carriers such as Continental Airlines and Alaska Airlines, have utilized mobile to appeal to sophisticated travelers who seek updates and expedited travel processes. American Airlines offers mobile boarding passes using two-dimensional 2D bar code at 27 airports across the country. This offering began in November 2008 with 3 airports and has since expanded to 27 nationwide. The boarding pass can be saved directly to a mobile device, which is critical because no Internet connection is required to retrieve it. This service provides added convenience to travelers as well as eliminates costs for the airline, e.g., paper boarding passes, the need for ticket agents to assist customers or space dedicated to ticketing terminals. However, given the importance of catching a flight, consumers may be hesitant to adopt this technology until it has been significantly vetted.