Onshore Oil and Gas Resource Leasing Process

Based in the General Mining Act of 1872 and the Mineral Leasing Act of 1920, the BLM’s process for leasing onshore federal oil and gas resources has been in place for decades and is well established, though some changes have occurred in these acts. This process is distinct from ROW processes used for solar and wind energy development because it deals primarily with subsurface property rights instead of surface rights.

Process Background

For each BLM field office with oil and gas resources, BLM-managed lands within the field office are first declared open or closed to drilling through the Resource Management Plan (RMP) process. In the RMP process, the BLM analyzes reasonably foreseeable oil and gas development and spells out stipulations to attach to leases.1 The RMP process includes a full NEPA analysis and a corresponding EIS. Once the RMP is adopted, a parcel can be nominated for leasing, and if the parcel is congruent with the RMP, the BLM attaches appropriate stipulations and brings the parcel to a lease sale.2 Lease sales, which typically happen quarterly and are conducted by the state BLM office, are competitive. The lease is for a period of 10 years, and is a conveyance of the property right for the subsurface estate in the given parcel. If a parcel is nominated and brought to the lease sale but receives no bids, it can be leased non-competitively after the sale.3

As the lease sale is a conveyance of the property right for the subsurface estate, the leaseholder must then file an Application for Permit to Drill (APD) to gain permission to place infrastructure on the surface and to engage in resource extraction.4 Additional project-level analysis then occurs. For large projects, a full EIS is produced, but for smaller projects where the BLM feels the impacts of the proposed drilling has already been accounted for in the RMP process, a Documentation of NEPA Adequacy (DNA) statement is issued. When granting an APD, the BLM attaches Conditions of Approval, which are additional stipulations dealing with surface management issues, and then approves, approves with modification, denies, or defers action on the application. Once granted, an APD is valid for 2 years, or until the lease expires, whichever comes first.5

Additional requirements exist for oil and gas drilling. The leaseholder must pay rental fees of $1.50 per acre for first 5 years of the lease, and $2 per acre every year after, whether or not the lease is in production.6 Royalties, collected by the Minerals Management Service, must be paid of resources extracted and are shared by the federal and state governments. Bonding is also required to fund the reclamation of the disturbed lands. Reclamation begins as soon as possible after drilling ends and continues until the BLM determines reclamation efforts successful. Each BLM state office has established standards for environmental mitigation to provide uniformity across the state offices. Specific mitigation standards are attached to APDs and put in through the project-level EIS or DNA.

Implications for Solar Facilities

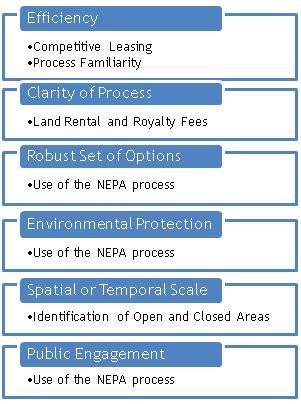

Many strengths of the oil and gas leasing process could, hypothetically, be applied to solar facilities (Table). One strength, use of the NEPA process, already exists in the solar process. Another, process familiarity, comes with time. Other aspects would not be as easily transferable.

The land use planning process for portions of the CDCA or for the CDCA as a whole could identify areas open and closed to solar development, allowing for spatial scale considerations. Legally prohibited or other high conflict areas could be excluded at this stage, leaving no ambiguity for solar developers. Parcel nomination could likewise be applied to solar development if a competitive lease or competitive ROW process was adopted.

With a direct application of the oil and gas leasing process, solar developers would be required to obtain a lease for land through competitive bidding, then submit a POD and wait for approval for the actual facility, similar to an APD. This could present some challenges. If the BLM sold a lease for an area and then did not approve the developer’s proposed solar facility, the BLM could not revoke the lease and sell it to a different company. This would be taking of property, prohibited under the 5th Amendment to the Constitution. A lease of the surface estate in place of a ROW easement would also prevent the continued management the land by the BLM for the term of the lease. This is a likely reason BLM uses a ROW process for surface rights. A competitive ROW process may be more favorable than a competitive lease sale. Whether a lease sale or ROW is used, the length of the lease or ROW would have to be appropriate for solar facilities, likely longer than the 10-year term used in oil and gas. Once the lease or ROW is granted, an EIS would be needed for the proposed solar facility before the facility could be approved.

As with the oil and gas leasing process, rental fees, reclamation bonding, and environmental mitigation standards are needed for solar development, either at the national or state levels. This would reduce uncertainty for developers and BLM staff. BLM does not have the authority to assess royalties based on energy production on public lands, but could base rental rates on total installed capacity of a solar facility.

Integration with Other Processes

If the oil and gas leasing process were to be applied to solar facilities in California, the process would need to be integrated with other approval processes. During the land use planning process and designation of open and closed areas, it would be necessary for the BLM to consult with the CalISO to ensure that access to the transmission grid is feasible from the areas designated open for solar, likely requiring one or more system impact studies. Because an additional EIS (beyond the EIS for the land use planning process) is likely to be required for all utility-scale solar facilities, the CEC process would be able to work in parallel with this project-level EIS, much like the current application of the ROW process for solar.

1 U.S. Bureau of Land Management, Leasing of Onshore Federal Oil and Gas Resources, http://www.blm.gov/wo/st/en/prog/energy/oil_and_gas/leasing_of_onshore.html.

2 U.S. Bureau of Land Management, Leasing of Onshore Federal Oil and Gas Resources, http://www.blm.gov/wo/st/en/prog/energy/oil_and_gas/leasing_of_onshore.html.

3 U.S. Bureau of Land Management, Questions and Answers About Leasing, http://www.blm.gov/wo/st/en/prog/energy/oil_and_gas/questions_and_answers.html.

4 U.S. Bureau of Land Management, Leasing of Onshore Federal Oil and Gas Resources, http://www.blm.gov/wo/st/en/prog/energy/oil_and_gas/leasing_of_onshore.html.

5 U.S. Bureau of Land Management, Leasing of Onshore Federal Oil and Gas Resources, http://www.blm.gov/wo/st/en/prog/energy/oil_and_gas/leasing_of_onshore.html.

6 U.S. Bureau of Land Management, Questions and Answers About Leasing, http://www.blm.gov/wo/st/en/prog/energy/oil_and_gas/questions_and_answers.html.